Tax-Advantaged Retirement Accounts for U.S. Business Owners

A savings account is great for when you want cash to cover you for a rainy day or to pay for that dream vacation you’ve had your eye on. But saving up for retirement? You’re going to need something different:

A tax-advantaged retirement account.

Why It’s Important to Start Saving Now

Striking out on your own with a WordPress business feels good, doesn’t it? You have the freedom to set your own hours, choose your clients, and dictate how much money you make.

But there’s a financial burden that comes with owning your own business — something many U. S. agency owners don’t fully think through or prepare for when they dive head-first into their business.

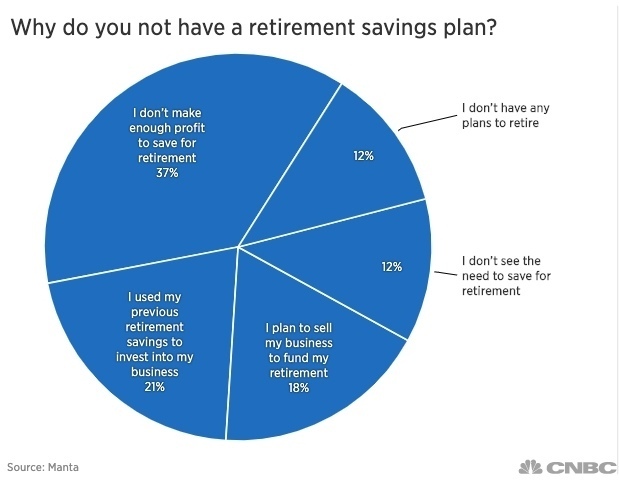

In a Manta survey from 2017, 34% of entrepreneurs reported not having a retirement account.

These were the top three reasons why:

- 37% attributed it to a lack of or insufficient profit.

- 21% used their previous retirement account to fund their current business.

- 18% planned to use the profits from the sale of their current business to fund retirement.

Look, I get it. It’s not easy starting a business from the ground up, so it might not seem feasible to put any money towards retirement in the beginning. However…

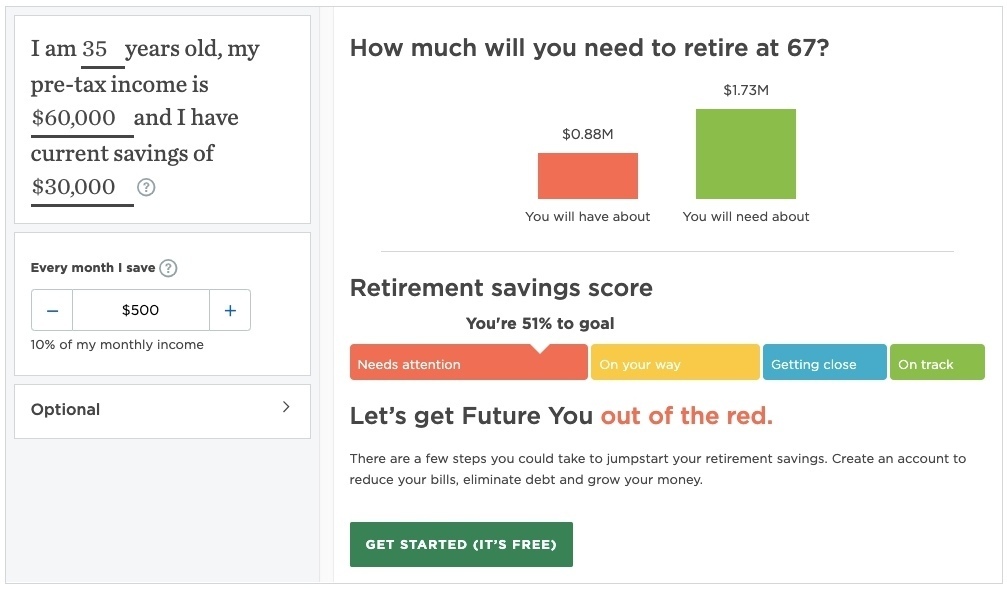

Most financial experts advise that you save at least $1.5 million by the time you retire. If you want a more exact estimate of how much you’ll need to live comfortably, use the Nerdwallet Retirement Calculator:

Regardless of what retirement goal you end up with, you have to start saving that money today — even if your WordPress business will eventually fund a good chunk of your nest egg.

Tax-advantaged Retirement Accounts for U.S agency owners

After you’ve claimed a profit and salary for yourself, and you’ve paid your business’s bills, don’t be so quick to dump the remainder of your earnings into a savings account. Tax-advantaged retirement accounts were built not just to help you grow your savings for retirement, but to also reduce your tax burden.

Tax relief comes in a couple different forms:

Tax-deferred: You fund your account with pre-tax dollars. As a result, you effectively lower your taxable income. So, the more you contribute to retirement, the less you pay in taxes. However, you will be taxed when you withdraw that money at retirement. There’s also a strict penalty if you attempt to withdraw the money before then.

Tax-free distributions: You fund your account and are taxed on the contribution now. However, when it comes time to use that money in retirement (or beforehand), there are no further taxes to pay. It’s all yours.

This is just one of the things you have to keep in mind when you decide on which taxadvantaged retirement accounts you want to contribute to.

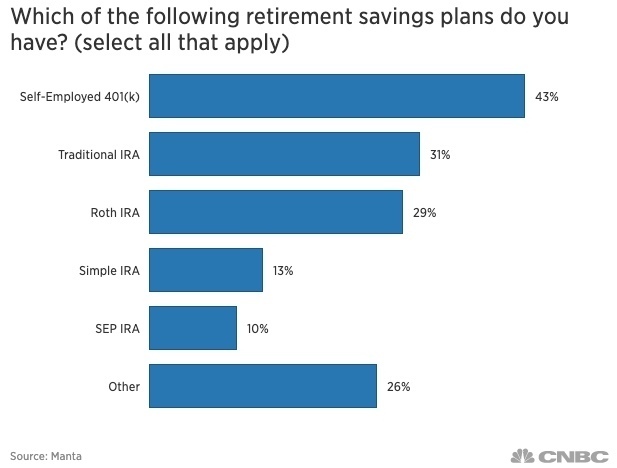

According to the Manta survey, these are the most popular retirement accounts used by U.S.-based entrepreneurs:

Here’s what you need to know about these tax-advantaged retirement accounts:

Self-employed 401(k)

For those of you who’ve worked for companies that contribute to employee 401(k)s, you have a pretty good idea of how this works. The key difference here is that you’re the sole contributor to your 401(k). That said, you can contribute twice — once as your employer and once as the employee.

Tax advantage: tax-deferred

Annual contribution limit: maximum $56k under 50yo; maximum $62k over 50yo

Withdrawal age: 59 ½

Required minimum distribution age: 70 ½

Traditional IRA

A traditional individual retirement account (or IRA) is one you set up apart from an employer, be it yourself or someone else. So, unlike the solo 401(k) where you can contribute to your retirement as an employer and employee, you get only one contribution with a traditional IRA. This also means that your contribution limits will be significantly lower.

Tax advantage: tax-deferred

Annual contribution limit: maximum $6k under 50yo; maximum $7k over 50yo

Withdrawal age: 59 ½

Required minimum distribution age: 70 ½

Roth IRA

A Roth IRA is the non-tax-deferred counterpart to the traditional IRA. What this means is that the contributions you put into your IRA will be taxed as income now. However, the tradeoff is that you can withdraw funds at any time and you won’t be taxed when your retirement savings are distributed back to you.

Tax advantage: tax-free distributions

Annual contribution limit: maximum $6k under 50yo; maximum $7k over 50yo

Withdrawal age: —

Required minimum distribution age: —

SIMPLE IRA

The “simple” in SIMPLE IRA stands for “Savings Incentive Match PLan for Employees”. In other words, you can invest in this type of IRA if you’re a small agency owner and you have employees whose retirement you’re contributing to. And because you’re also an employee of the company, you can contribute to yourself twice using the contribution limits stated below.

Tax advantage: tax-deferred

Annual contribution limit for agency owner: maximum $13k under 50yo; maximum $16k over 50yo

Annual match limit for your employees: match employee contributions up to a maximum 3% of their salary or a fixed 2%

Withdrawal age: 59 ½

Required minimum distribution age: 70 ½

SEP IRA

“SEP” stands for “Simplified Employee Pension”. This is a strictly employer-funded IRA plan. And while you might be tempted to create a SEP IRA just for yourself — considering the higher contribution limits and lower fees — you probably won’t want to. If you give yourself any kind of contribution, you have to pay the same exact percentage to each of your employees’ SEP IRA plans.

Tax advantage: tax-deferred

Annual contribution limit: up to 25% of employee’s salary or maximum $56k

Withdrawal age: 59 ½

Required minimum distribution age: 70 ½

Wrap-Up

For those of you operating WordPress businesses out of the United States, you don’t have the benefit of the government contributing funds of their own towards your retirement. (Your Australian agency owner friends, however, do.)

Because of this, it’s all on you to set up tax-advantaged retirement accounts and feed the right amount of money into them starting right now.

If you have any questions on how to do this or how much money to start saving from your WordPress business, get in touch today!