How to Make Australian Super Funds Work For You When You’re Self-Employed

You didn’t ditch the corporate life and start your own WordPress business so that you could bust your hump long past retirement age. Thankfully, the Australian government contributes some money towards your retirement. However, the Age Pension won’t be enough to provide you with the comfortable life you deserve.

A properly managed superannuation fund will, though.

Why You Need More Than Just the Age Pension

Australian retirees 67 years of age or older are eligible to receive assistance through the Age Pension. As of writing this, these are the standard payouts provided by the government:

Based on how much money you saved as well as invested in assets, however, those numbers may be smaller by the time you reach your retirement years.

According to ASFA, this is the recommended allowance for a modest lifestyle versus a comfortable one for a retiree in Australia:

As you can see, the Age Pension barely covers the costs of a modest lifestyle for a single individual, let alone one in a relationship.

Because you’re not employed by someone else, you unfortunately don’t get to reap the benefits of the 9.5% contribution they’re required to make to your superannuation fund (i.e. retirement savings account). Needless to say, it’s all on you to start saving money now, so you’re not stuck working while your peers are able to kick back and enjoy retirement.

There’s just one problem with that: self-employed Australians haven’t done a great job of putting money into their super funds.

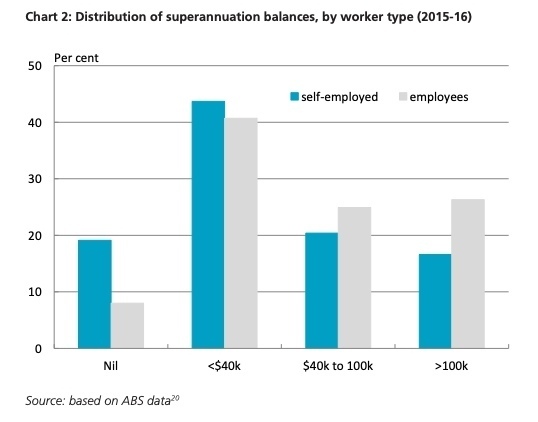

ASFA issued a report in 2018 about the super balances of the self-employed. These were just some of the startling statistics it revealed:

- 10% of the Australian workforce is self-employed, but only contribute 5% of super contributions.

- 19% of self-employed Australians have no super compared to only 8% of employees who don’t.

- 17% of those self-employed have over $100,000 in their super whereas 26% of the employed workforce does.

What’s worse, there’s a large discrepancy between self-employed males and females in the run-up to retirement. By the age of 64:

- Men, on average, have $143,130 in their super.

- Women, on average, have $82,951.

I get that it’s difficult trying to contribute anything to a super and to grow your savings when a business is new. However, that doesn’t mean you can afford to postpone it for too long. The longer you wait, the more you’ll have to sacrifice in retirement.

How to Make the Most of the Australian Super

You’re going to need an income by the time retirement rolls around, whether that’s at age 67 or earlier. The Age Pension will help… a little bit. But the tax-free income provided by your super fund is what will ultimately determine how comfortably you live.

Here’s how you can make the most of it:

Contribute As If You Were Employed

Even though you’re self-employed, you still take care of yourself the way an employer would, right? You pay yourself a salary. You provide yourself with benefits. Heck, you even allow yourself to take time off every now and again.

So, why wouldn’t you contribute to your savings the way your employer would be obligated to do so?

Granted, an employer is required to contribute a minimum of 9.5% of an employee’s wages to his or her chosen super fund. That may be too steep if your WordPress business is brand-new or just starting to grow. And that’s okay. Determine a reasonable rate — for now — and automate those contributions.

Every little bit helps.

Make the Right Kind of Contributions

There are a couple of ways to contribute income to a super. You can get more from your contribution if you use them wisely.

Concessional contributions:

- Can be made as a 9.5% employer contribution or salary sacrifice contribution.

- Tax-deductible contributions up to $25,000 each year.

- Contributions are taxed at 15%.

- Excess contributions are taxed at a higher rate (up to 47%). However, you’re able to withdraw up to 85% of them, if need be.

Non-concessional contributions:

- Can be made by you or your spouse with after-tax income.

- Not tax-deductible. Can contribute up to $100,000 each year.

- Earnings are taxed at 15%.

- If you experience a windfall, you can contribute additional funds. If your super has less than $1.4M, you can contribute up to $300k. If it has more than $1.5M, you can contribute up to $200k.

While you’ll have to deal with taxes regardless of which way you contribute, you can navigate the system to ensure you maximize your retirement income in the end.

Know What Kinds of Super Funds You Can Invest In

There are a variety of super fund types you can invest your savings in.

MySuper – Created by the Australian government, this is the simplest and most cost-effective of super funds. You pay only for the features that you need, and how you invest and what you earn from it is relatively straight-forward.

Industry Funds – Unless the fund is for people working in a specific industry, these are open to all. While they can be more expensive than MySuper funds, they’re “not for profit”, which means that profits go back to you and not the fund manager.

Retail Funds – You can procure these types of funds from financial or investment firms. There’s a greater variety of investment options than with other types of funds. However, it also means generally higher prices, too. You might also have to work with one of their financial advisors, so expect them to take a cut of your earnings.

Corporate Funds – If you want to set up a super fund for your employees, this is the kind you’ll use to do it.

Wrap-Up

It doesn’t matter where you live in the world. If you want to have an enjoyable life in retirement, you’re going to have to start saving for it today.

Thankfully, Australia’s Age Pension will help pad your retirement income. And, if you were previously employed, your employers’ super contributions will help as well.

However, the rest is up to you. If you’re unsure of how to set up your first super fund or you’re struggling to contribute enough to it each year, get in touch today. We’d be happy to help!