How to Strengthen the Financial Foundation of Your Business

Picture the journey you’re on with your business as a race. Which one would you rather compete in?

A shorter trek that takes you up steep inclines, down paths littered with rocks and brambles, and along the generally unsteady ground?

Or:

A longer trek along a well-lit and well-paved path that steadily rises in elevation?

Even if your adventurous spirit is telling you to go for the seemingly more exciting of the two journeys, the side of you that decided to start a business is going to advise caution. That’s because deep down inside you know you can only take so many risks and hop over so many stumbling blocks before one of them takes you down for good.

Your business’s financial foundation needs to be like the latter of those two races: steady, predictable, and manageable.

How to Strengthen the Financial Foundation of Your Business

The key to creating and strengthening the financial foundation of your business is to stabilize your cash flow. If you can predict the amount of money leaving your business and the money coming in, you can tum your focus towards making more of it.

Here are the three things you need to do to lay down a solid foundation for your business.

1. Set a Budget

Look, you’re going to have to spend money on your business if you intend to make money with it. However, that doesn’t mean that the more money you spend on it, the more money you make. It doesn’t work that way.

Instead, you want to set a budget that keeps costs even and predictable. That way, when you grow your revenue, costs stay put so you can increase your profit margins.

Then, ask yourself:

“Are all these necessary?”

Anything that’s not should be canceled immediately. Anything that’s necessary, but has a cheaper alternative, should be downgraded.

Download our Monthly Money Finder to help you make decisions.

Pay only for what you need so you can keep costs reasonable and manageable as you grow.

Add up the monthly costs. This will be your guide for your expenses going forward.

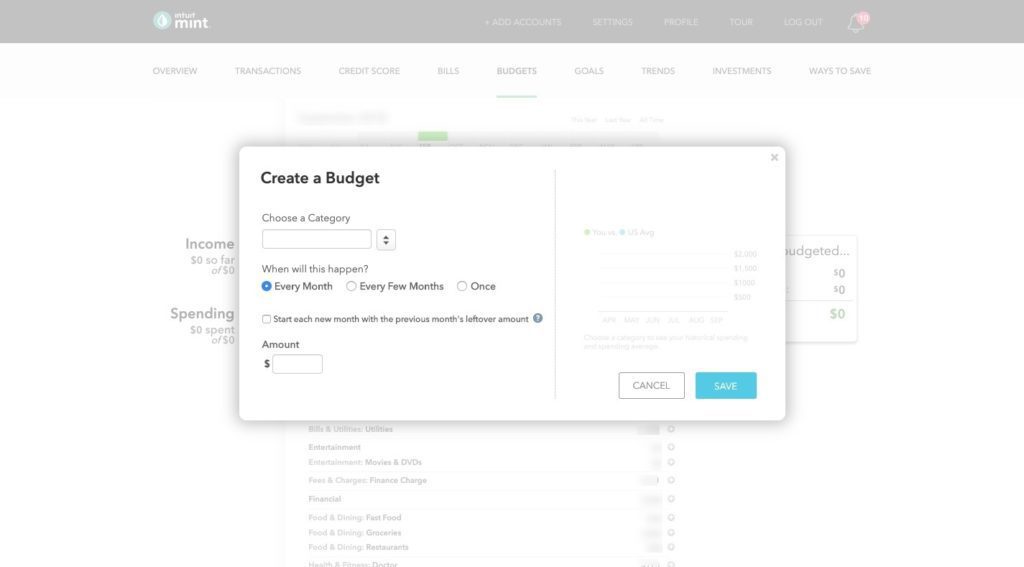

Pro Tip: Sign up for Mint. This is Intuit’s manager tool that pulls in data from QuickBooks (another software we’ll talk about soon) to help you more easily track and manage your monthly budget.

2. Make Money

Now that you know how much money you have to spend to keep your business running, you can easily figure out how much money you need to earn to:

- Cover those costs.

- Help you chip away at any cost-of-living expenses outside the business.

- Create a life that’s comfortable for you while enabling you to grow your kickass business

Just don’t lose sight of the fact that you have to charge clients a rate that is commensurate with the value you deliver.

If you undervalue your services, you run the risk of putting your business in the red or putting yourself into burnout mode to prevent that from happening. If you overvalue your services, you’ll have a hard time finding clients willing to work with you. Either way, both your business and personal financial states will suffer.

It’s a delicate balance you must strike.

If you’re struggling to get clients to see the value of your services, it may be time for a rebrand. Or to target a new audience that can afford the quality of services you provide. In addition to charging enough money, you should look for ways to establish a passive and recurring revenue stream. For agencies and freelancers, you’d be best off doing this with:

- Premium plugins or themes

- Audit what your client is already doing

- Webinars

- Website maintenance services

- Affiliate marketing

- Information Product

This way, even if it takes time to accumulate a steady flow of clients through your business, you’ll have a predictable source of income piling up in the background.

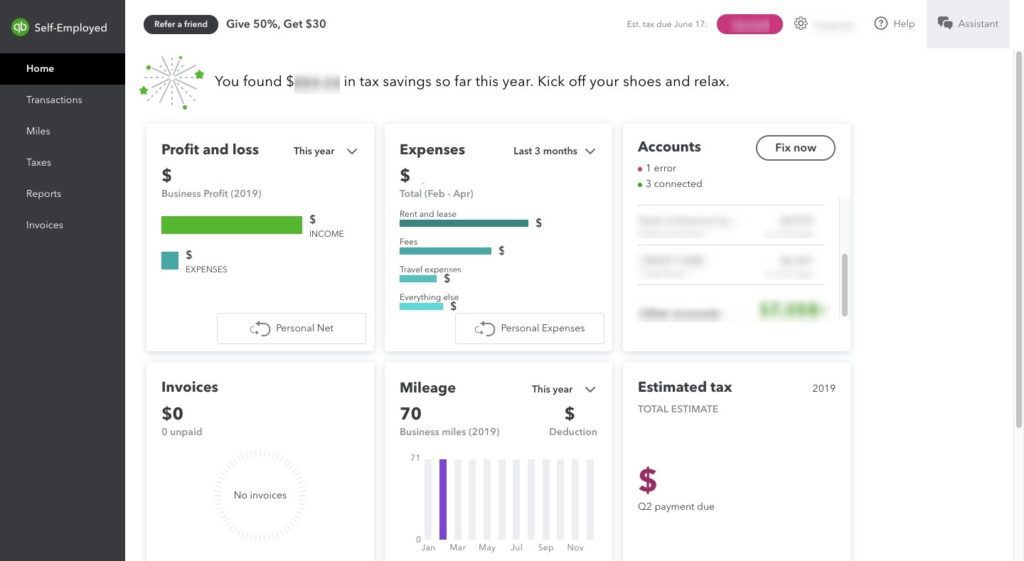

Pro Tip: If you’re using Mint to manage your budget, use QuickBooks (another Intuit software) to track your income against your spending. This will take the pressure off of you to have to track earnings and to know how much money you’re actually bringing in to the business. You can also more easily spot trends with this tool.

3. Save Your Earnings

The reason why undervaluing your services can be so problematic is because the equation isn’t as simple as:

Monthly Business Costs = $1,500

Monthly Income= $5,000

My Money= $3,500 (???)

That $3,500 difference doesn’t go directly into your pocket (at least, it shouldn’t if you ‘re doing this correctly).

Yes, you need to get paid a wage for your own business. However, you need to put money aside to protect your business. Without the right money management system or safety nets in place, an unpredicted lull in business, or an illness or accident that forces you to step away from it, could cause serious financial harm.

Here is what you should do to ensure you’re always covered:

- Create separate accounts for personal and business finances.

- Deposit a portion of your monthly earnings to cover costs into a specified business checking account.

- Put aside enough money to cover your self-employment taxes.

- Distribute the rest as follows:

- Pay yourself a salary and put it into an account that’s yours to do with as you like.

- Create a rainy day fund that contains enough money to cover you for six months, at least.

- Put a set amount of your earnings into a high-yield savings account. This can be used for big purchases you want to make.

- Deposit the rest into a 401k or Roth IRA retirement account – and start investing when you’re ready.

- Automate these contributions, so you don’t have to worry about whether or not you’re saving enough money.

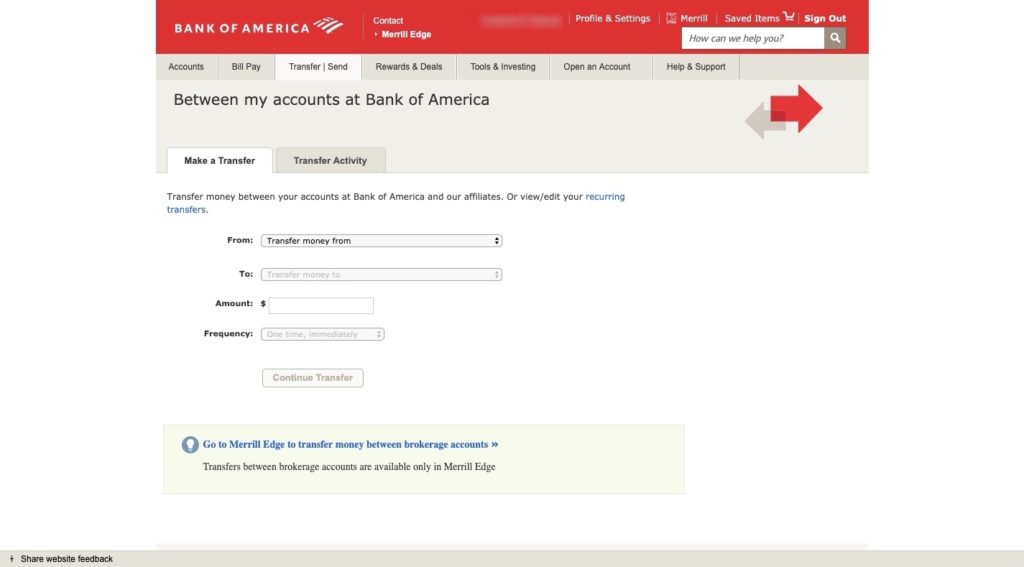

Pro Tip: Most banking institutions allow you to create different kinds of accounts – e.g. checking, savings, retirement – and to automate your contributions to each. Bank of America, for instance, allows you to schedule recurring payments among your accounts, including any.

Retirement accounts you hold at Merrill Edge. This makes saving your earnings much easier.

Wrap-Up

By giving yourself a stable financial foundation to stand on, you’ll spend less time stressing over the security of your business. You can then reinvest that time into your business – setting achievable goals, refining processes, marketing to new clients, and doing all of the other things you need to do to keep profit margins up.

Stressed over your money and nervous that your expenses will affect your business’s stability? Download this worksheet and start on the track of understanding your money by first learning a framework to make better decisions.