Where to Get Free Financial Advice for Your Business

If you’ve ever spoken with an accounting firm or financial planner, then you know how exciting it is to imagine someone else managing your business’s finances for you. Relief doesn’t even begin to cover it.

But then you receive a quote for their services.

How the heck are you supposed to pay them to manage your finances or, at the very least, advise you on them, if you don’t have enough money to pay yourself enough yet? That’s a big problem and one that could realistically keep you from hiring someone to provide financial advice and support you need right now.

So, what do you do? Just keep trudging along with the status quo – not knowing your numbers and not knowing what to do with them once you have them?

Like a lot of what you do as a small agency owner, you’re going to have to take the DIY approach until you make serious headway with your finances. Don’t worry. There are some great resources that provide free financial advice that is both useful and will enable you to take immediate action on.

Let’s take a look:

1. Use Foundation for Financial Planning Resources

To be clear, most of you won’t be able to leverage the Foundation for Financial Planning‘s network of pro bono financial advisors. The free service is only available to people in dire need or crisis.

However, the Foundation for Financial Planning has a number of free consumer resources you can use. There are:

- eBooks

- Online courses

- Worksheets

- Finance checkup tools

Because these are meant more for consumers struggling with personal debt and general finance management, that’s mostly what you’ll find here. However, if your personal financial state is affecting your professional one, this is the best place to start.

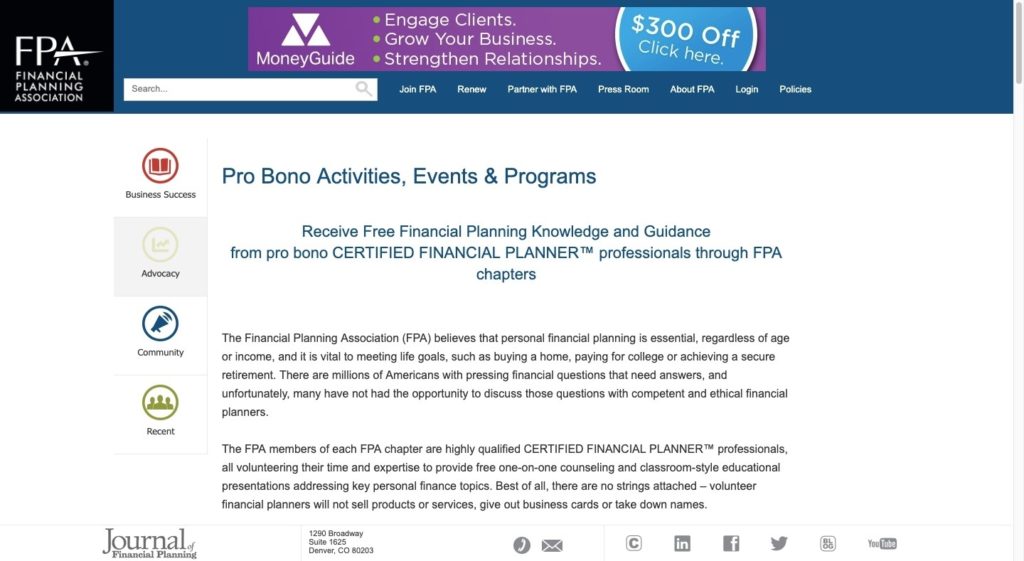

2. Attend a Financial Planning Day

The Financial Planning Association (FPA) is another organization that aims to help consumers in need. However, their local chapters occasionally offer financial planning days where you can meet with a certified financial planner for free.

If you’re having a hard time, in particular, with saving money for business or planning for retirement, check to see if your local FP A is planning one of these free events. They don’t run too often, but they’re worth checking out when you can find them. (Here’s an example of one held in Baltimore earlier this year.)

3. Subscribe to Your Favorite Money Blog

If you’re reading this, then you probably enjoy scouring the web or social media for stuff to read – especially when it helps you improve your business. If that’s the case, then you should subscribe to your favorite money blog and let it pour free financial advice into your inbox on a regular basis.

If you don’t have one yet, give these money blogs a shot:

And don’t forget to bookmark this blog! We have a lot more content coming your way.

4. Listen to Your Favorite Money Podcast

If your response to the previous two suggestions was, “I don’t have time to read”, I get it. So, why not try a podcast instead? You can listen to it while you’re working out at the gym, cooking dinner at home, or going for a long drive.

Here are some of the best podcasts for small agency owners trying to build a business and improve their financial health:

While every topic won’t cover finance management directly, these business lessons will help you gain better control over your business so that money becomes less of an issue along the way.

5. Talk to Your Mentor

First, I should ask: Do you have a mentor? If not, you should work on finding someone, especially if you’re working on your own.

Small agency ownership is tough and it’s important to have someone to talk to about your ups and downs. If you can find someone with whom you feel comfortable chatting about money, that’s even better.

6. Talk to Your Facebook Group

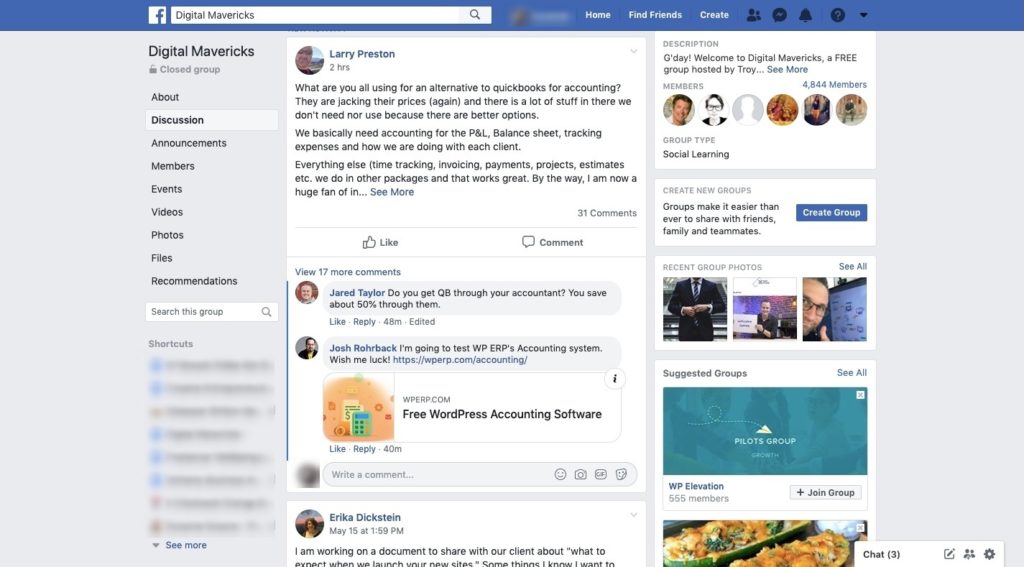

Finding the right Facebook group can do wonders for your company’s growth and success. Take, for example, the Digital Mavericks group run by WP Elevation.

Although you’ll find a good mix of questions here, chances are good you’ll see finance-related questions (like the one above) pop up in the news stream. That’s because all of us working in creative fields (like WordPress design) are thinking about the same thing:

How do we make more money and do it wisely?

Whether you work with WordPress or want to focus on another niche, there’s definitely a Facebook group filled with like-minded agency owners with financial questions and advice to help you out.

Join our Facebook Group Think Tank for Agency Owners and Freelancers to get questions answered and learn lots of helpful hints.

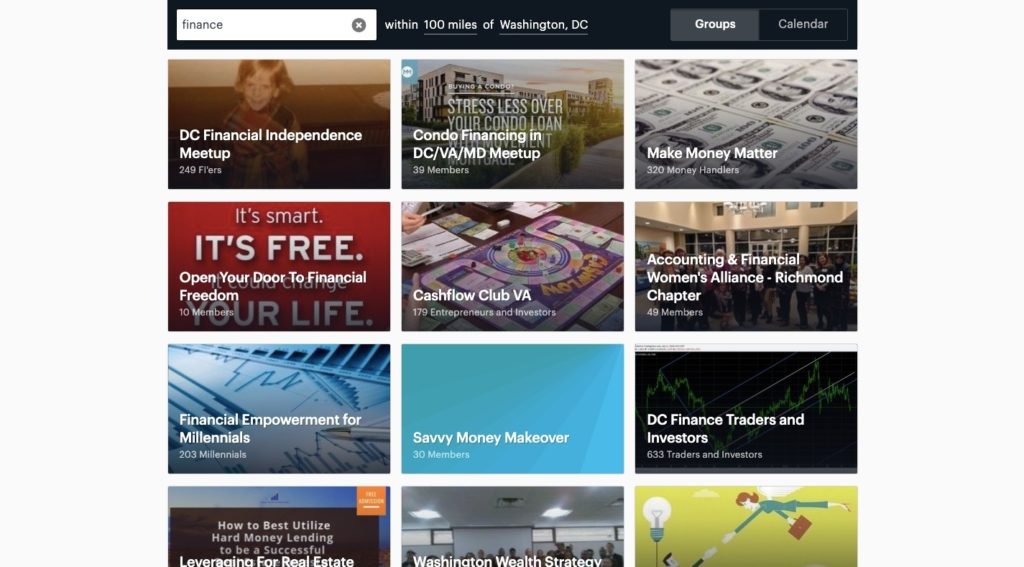

7. Attend a Meetup

While you’re not likely to find a free local class to help you manage your finances, you can certainly find a free local Meetup that focuses on relevant topics.

Don’t be afraid to look for other kinds of Meetups beyond the ones with a finance focus.

Professional Meetups might hold the occasional meeting with a finance spin, too.

8. Look Inside Your Money Management App

There are 3 kinds of money management apps you should be using for your business. But did you know that many of these tools do more than just track your cash flow and manage it?

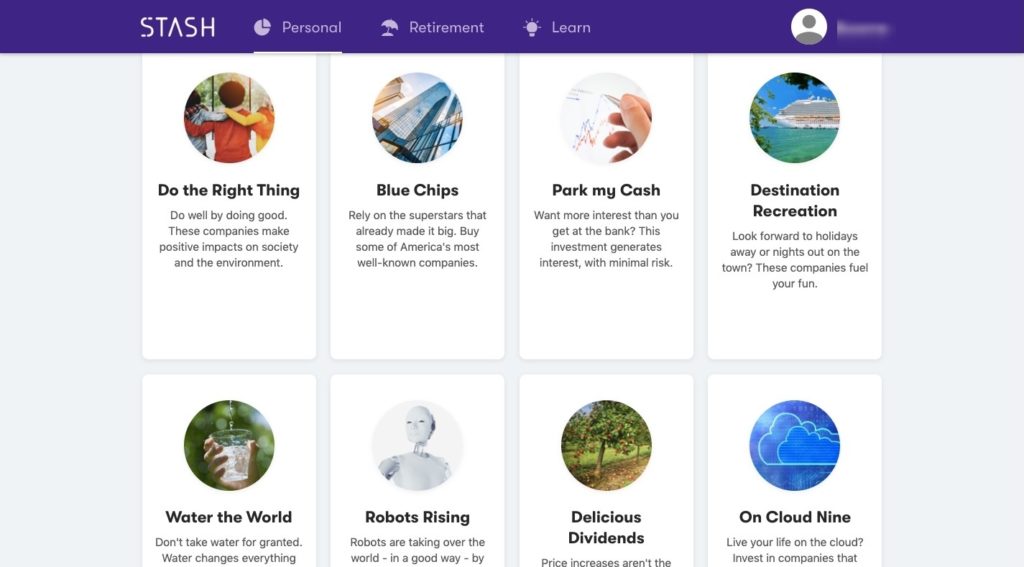

Take Stash, for example.

Stash has a “Learn” blog where you can read up on how to save your money and spend it wisely.

And if you look at other parts of the app, you’ll find that it’s chock full of educational opportunities. If you’re not in a position to hire an investment manager or adviser, you can let Stash teach you about the kinds of money moves available to you.

Free Financial Advice: Is It Worth It?

In all honesty, if your goal is to substantially grow your business – and perhaps even to the point where you can sell it – you will eventually need to get a finance professional on your side.

In the meantime, though, these resources are a great place to tum to for free financial advice that you can DIY.