6 Pocket-Sized Money Managers You Should Know About

Hiring professional money managers is expensive, right? But you do it, possibly because you’re not comfortable playing with your business’ numbers on your own.

In all fairness, unless you’ve taken a REALLY great finance course or simply enjoy the challenge of analyzing data, the matter of money management probably isn’t one you’re too eager to tackle. On the other hand, when your business is young and revenue less than stable, you’re probably not all that excited to hire an accountant or financial advisor to do it for you either.

But if you’re not regularly analyzing your numbers to understand where you stand financially, it’s going to be very hard to make any real strides in your business. In fact, money issues are often the reason why small businesses fail, as evidenced by this report from CB Insights:

So, let’s assume you feel stuck. You know you need to tighten the purse strings and get a better handle on cash flow, but you don’t want to pay someone to do it and you don’t want to handle it yourself. That’s why you need a set of money management apps to do it for you. Just their mere presence in your browser bookmarks or installed on your mobile device will keep you in that “I need to be smart with my money” mindset.

But which ones do you use?

In this post, I’m going to share which of these money management apps are essential for your business.

Essential Money Management Apps for Your Business

To strengthen your business’s financial foundation, you need to know your numbers as well as how to move your money around wisely. Expenses need to be covered, taxes paid, and you deserve a salary at the end of the day, too.

The following money management apps are going to be an essential part of your company’s financial success and your own financial freedom.

1. Accounting App

It doesn’t matter what stage of business you’re in, whether you just started it today or you’re months or years in. An accounting app is absolutely essential for every agency owner to have.

With an accounting app, you can do things like:

- Monitor all of your business (and personal) accounts.

- Track cash flow and profitability.

- Issue invoices to clients and contractors.

- Collect payments.

- Categorize expenses.

- Log miles and other travel-related costs.

Here are some of the best accounting apps for small agency owners:

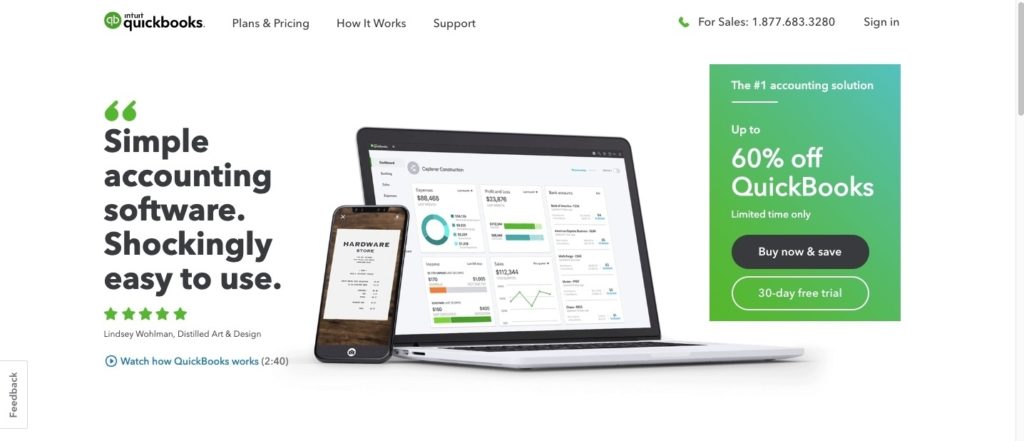

QuickBooks

QuickBooks has a scalable set of accounting solutions for businesses at every stage of the game. If you want your accounting software to grow with you, this is the best choice. To sweeten the deal, QuickBooks is part of the Intuit ecosystem, which means you can connect it to your TurboTax account for streamlined tax preparation and it’ll even help U.S. agency owners make their quarterly payments on time.

Fresh books

FreshBooks is another fantastic option for small agency owners who want to spend less time doubling as money managers.

The key advantage with FreshBooks, however, is its ability to integrate with a wide variety of other applications. So, not only can you track cash coming and going out of your business, you can handle invoicing and payroll through it, too.

2. Accounts Payable and Receivable App

These days, most accounting apps come with invoicing and payment integration (like the examples above). However, if your app doesn’t take care of that or you want to keep those systems separate, you can certainly use an app made specifically for accounts payable and receivable.

Regardless of which route you go, it’s important to find an invoicing app that simplifies as much of the work as possible with:

- Invoice templates

- Recurring invoices

- Automated scheduling

- Late invoice tracking

- And so on

Payment apps also need to make your life easier. So, if you have freelancers or other third-parties to pay, your app needs to make light work of that.

Here are some of the best accounts payable and receivable apps for agency owners:

PayPal

PayPal is a great money management tool for both your personal and professional needs.

However, its merchant services are what you’ll really want to put to work for you in the way of sending out invoices and processing payments – either by invoice or from a payment gateway on your website. You can also use it to issue payments to contractors and vendors.

Bill.com

Bill.com is another all-in-one accounts payable and receivable solution for small agency owners.

Not only does it integrate seamlessly with most of the leading accounting software solutions (including QuickBooks), it’s also scalable. That’s especially nice since you won’t have to worry about transitioning to another solution just as your business starts to pick up momentum.

3. Savings and Investment App

While you absolutely need to make sure everyone gets paid (including yourself), putting enough money aside for savings and investing is just as important. This is how you’ll grow your nest egg and protect yourself in retirement.

Now, investing can be complicated as well as risky, and if you’re not yet in a comfortable spot to hire an accountant, then you likely won’t be ready for an investment manager. That’s fine since there are a number of digital money managers ready to help you get started.

Here are some of the best saving and investment apps for agency owners:

Albert

Albert refers to itself as a “financial assistant”, though it’s what this mobile app does to help you save money wisely that really makes it a standout among money management apps.

What’s really nice about this app is that it feels more personal than most finance apps that present you with dashboards of data and tell you the status of your cash flow. When you sign up for Albert Genius, financial experts get to know your spending habits, revenue trends, and will text you helpful tips so you can pay off debt and automate your savings. Soon, Albert will be able to help you invest, too.

Stash

Stash is another mobile app, only this one is strictly aimed at helping you invest your money.

This is a great option if you want to actually learn more about investing your hard-earned money while being able to take a backseat and let the app drive for you. What’s more, you can use this app to save money for specific personal goals (like buying a home or taking a vacation) or invest it and watch the money pile up for retirement.

Wrap-Up

It can be scary to look at your business’s numbers, so why not let a few apps do the dirty work?

You still have to muster up the courage to review your financial state on a regular basis, but you can reduce the anxiety that often comes with crunching the numbers and wondering if you’re even doing it right.

The money management apps above will cover all your bases so that you’re never in the dark about your finances – instead, you’ll have tools actively helping you improve your bottom line and grow your business.