How to Make a Budget Plan For Your Business – and Stick to It!

Do you ever feel like, no matter how much you earn from your Agencies and Freelancers business, you just can’t seem to make a sizable profit?

One of the reasons why that may be happening is because your spending too much in relation to your income instead of spending is disproportionate to your earnings. Good news – a budget plan can help with that!

Make Better Decisions! Do you REALLY need that new piece of software?

As we examined the three things needed to establish and strengthen the financial foundation of your business, the budgeting of costs was the first thing on that list. There’s a good reason for that.

It’s perfectly fine for your revenue dollars to change, so long as they always trend upward. It’s not okay for your costs to fluctuate. That said, I’m not telling you that you can’t reward yourself for a job well done. Or to spend money on your business when it’s absolutely needed. But if you’re splurging on an expensive dinner every time you close a $5,000 website, or you’re buying every new piece of software someone recommends on your favorite blog, you’re going to have a problem sustaining profits.

In this post, we’re going to take a closer look at how to make a budget for your WordPress business and stick to it.

Why Do You Even Need a Budget?

Having a budget gives you stability. With that, you gain the ability to predict future business outcomes and make smarter money moves.

Think about it this way:

If you constantly spend more than you bring in, you and your business will lose money.

If you constantly spend more than you bring in, you and your business will not make money but you won’t lose any either.

If you consistently earn more revenue than you spend, you and your business will make a profit.

Now, here’s where it gets messy. This happens when you have no control over your revenue, your costs, or both. Some months you’re up, some you’re down, but the point is:

You’ll have absolutely no visibility into or control over your business’s financial state.

And that’s dangerous territory to be in. So, let’s tackle the budget piece today.

How to Make a Budget for Your WordPress Business

Ready to learn how to make a budget for your business? Here’s what you can do to stabilize your spending and give your revenue much more room to grow.

1. Calculate Your Revenue Today

Even if you’re still working to bring more predictable income into your business, you should be able to calculate your average monthly revenue as of this very moment – a critical step towards making a budget plan with precision.

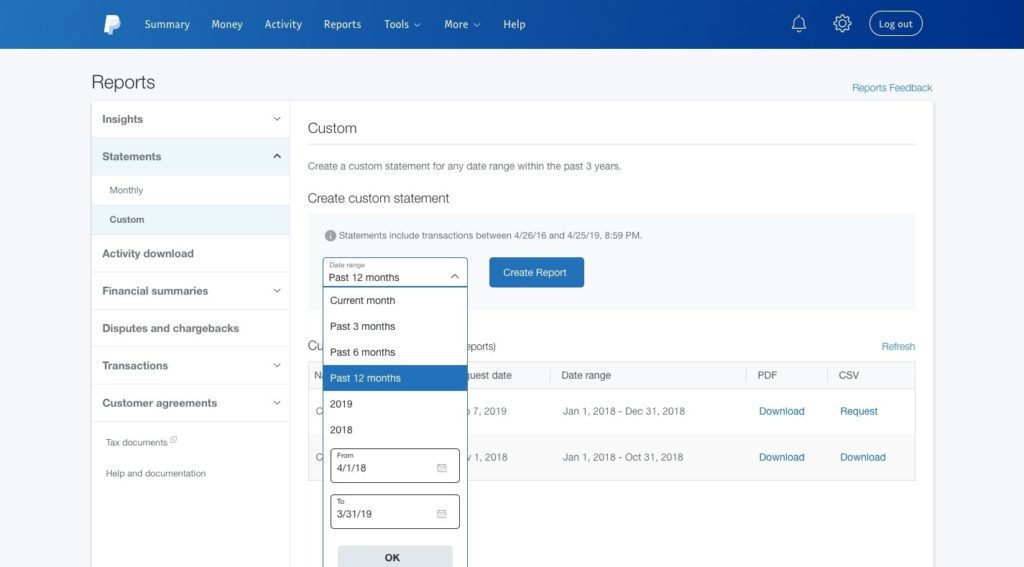

Log into your accounting or payment processing software and pull a report for the last twelve months’ of earnings. Here’s an example of how you’d do this with PayPal :

Grab your total revenue and divide the number by 12. This is how much revenue you average each month.

2. Tally Your Costs

Now that you know how much money you bring in each month, you have a working limit for expenses.

Using this Business Expense Tracker to help you to see how much you are spending each month. This will help you determine your expenses and to give you a number to see what you have to earn so that your card above with always show green.

The first column group will be where you list your bills. Bills are anything with a due date that is necessary to pay every month. This is also for any debts that you have. Write down in order by the due date and the amount that is due each month. The sheet will automatically total up the cost at the bottom.

The second column group is for your monthly subscriptions. Write down all your subscriptions and how much you pay per month. Even if you pay for a year at once, break it down to a monthly cost. This helps to keep the months even so you know how much you have to make monthly to cover the costs of your expenses. Please also list by the due date.

The third column group is for everything else. Write down all your expenses and how much you pay per month. Again, even if you pay for a year at once or by quarter, break it down to a monthly cost.

The tracker will add up each column and then also give you a total of all your expenses for a month.

Make sure when you compare that total to your monthly income, you end up with the green card above.

Getting down to the nitty-gritty now. We are now going to look at our money, figure out the best solution for you, and assign it to its job.

In this budget, our purpose is to record all of our income and our expenses and make sure that equals 0. This way you have assigned every single cent to work for you. This way money won’t be blown and at the end of the month, you have no idea where the money went.

You will begin at the end. Go to the last section of the budget. List all of your income here.

Now your job is to tell every cent of your income what job it needs to do for the month. Use the money tracker to help you identify all the expenses in a month.

The first section of the template is all of your “Due Date” bills. These are any bills that you actually have to pay on a certain day of the month. This is important for two reasons. One, you need to make sure you have enough money in the first half of the month coming in to pay these expenses and Two, these are the non-negotiable amounts that can not be eliminated to make your income – expenses = 0.

The second section is for your monthly subscriptions. And the last section is for everything else.

Miscellaneous is also very important…the first year, there are bound to be line items that you forgot about! Also, unexpected expenses come up randomly and this gives you a little wiggle room.

Don’t forget to pay yourself and save money for months that your income isn’t as high as other months.

The whole key to this section is to make sure the bottom of the 4th section equals $0 at the end of the day. So you must go in and adjust any numbers in your first 3 sections to make sure it equals $0!!!!!

3. Assign a Budget Cap and Spend Less than that Amount

Use Monthly Money Finder to examine each of your costs and ask yourself: “Do I need this?”

If “no”, then get rid of it.

If “yes”, consider alternative options. Could you be just as efficient with the free counterpart (if there is one)? Or is there an alternative you can replace it with that’s more cost-effective?

Use our Shiny Object vs Needed Tool worksheet to make sure you don’t return to overspending.

Wrap-Up

Look, there’s absolutely nothing wrong with spending money to make your business better. You know the old adage: “You gotta spend money to make money.” However, if you don’t have visibility into what you’re spending or a way to control it, don’t expect much in the way of business improvements. You need healthy profit margins in order to do that.

But by educating yourself on how to make a budget for your business, you’re starting on the right path. To help you along on this journey to growing a profitable WordPress business. Sign up for the waitlist for our class, and you will get our full budgeting class for FREE!